Submitted by nsscadmin on

November is Financial Literacy Month! Throughout the month the Nova Scotia Securities Commission will be sharing investor education content on our website, social media channels, and in person to help Nova Scotians make more informed investing decisions.

Here’s a look at some of the things we have planned for the month.

Our Before Your Invest Blog will be looking at some basic investment topics throughout financial literacy month. We’ll get things started on November 8 with a post on why you might want to invest in the first place. What’s in it for you? We’ll follow that introductory post we a new basic post every Wednesday on cash and cash equivalents, fixed-income securities, and alternative securities.

Terminology Tuesday

During Financial Literacy Month we’ll be bringing back our popular Terminology Tuesday post to our social media channels every week on Tuesday. Make sure you follow us on X (Twitter), Facebook, and LinkedIn and watch of our Terminology Tuesday post to learn the basic definition of some investing terms.

3 Minutes on … Videos

We’re bringing back our 3 Minutes on … video series during Financial Literacy Month. On Monday November 6 and 13 we’ll debut two new three minute videos on our YouTube channel. Our first videos will look at the basics of Stock Splits. and our second Compound Interest.

Financial Literacy Month Presentations

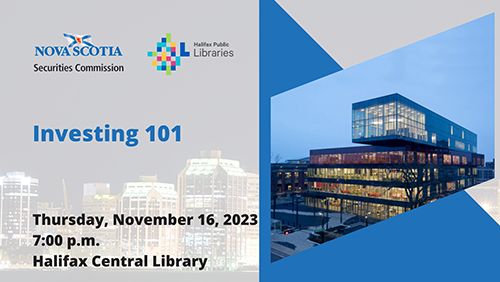

In November the Commission will be visiting the Halifax Central Library for two Financial Literacy Month presentations.

Thursday, November 16, 7:00 p.m. – Investing 101

Do you know the difference between saving and investing? What about an RRSP and a TFSA? Do you know your stocks from your bonds? Your mutual funds from your exchange-traded funds?

Join David Harrison from the Nova Scotia Securities Commission as he explains how securities regulation works in Canada and the difference between basic investments.

Thursday, November 23, 7:00 p.m. – DIY Investing: Is it right for you?

In 2021, 3.6 million Canadians opened DIY investing accounts. Should you jump on this rising trend? Is DIY investing a good fit for you and your financial goals?

Join David Harrison from the Nova Scotia Securities Commission as he explains the basics of DIY investing, some of the pros and cons, and how to determine if it’s the right path in your investing journey.

Our investor education presentation series at the Flourish Centre in Bridgewater continue in November with two presentations during financial literacy month. For information on attending please contact the Flourish Centre.

Monday, November 20, 11:00 a.m. – Basic Investments (Please note earlier time)

Do you know the difference between saving and investing? What about an RRSP and a TFSA? Do you know your stocks from your bonds? Your mutual funds from your exchange-traded funds? Join David Harrison from the Nova Scotia Securities Commission as he explains how securities regulation works in Canada and the difference between basic investments

Monday, November 27, 3:00 p.m. – Working with a registered financial adviser

Do you have a financial adviser who manages your investments? Maybe you’re looking for a new adviser, or want to assess the relationship you have with your current adviser? Do you know how investment advisers are registered and regulated in Nova Scotia? Join David Harrison from the Nova Scotia Securities as he explains the registration process of investment advisers in NS, some tips to follow when looking for a new adviser, or assessing your current client-adviser relationship, and what expectations you should and should not have in the client-adviser relationship.

Student Connections Program

Our Student Connections Program will be visiting schools and universities during financial literacy. Some of the schools on the schedule in November include Mount Saint Vincent University and C.P. Allen High School. If you would like the Commission to talk to your students, or you would like more information on these presentations, please contact us.