Submitted by nsscadmin on

It’s Investor Education Month and we’re going to test your investor knowledge.

How well versed in investor knowledge do you think the average Canadian is? According to research done by the CSA, Canadians investor knowledge needs improvement.

During the last Investor Index conducted in 2020 the CSA tested Canadians coast-to-coast using the Investment Knowledge Index. This quick seven question quiz helps to give regulators an idea on if Canada’s investment knowledge is high, low, or somewhere in between.

In 2020 49 percent of Canadians who took the quiz scored low, meaning they got 0-3 questions out of the seven correct. Here’s what percentage of participants got between zero and seven questions correct.

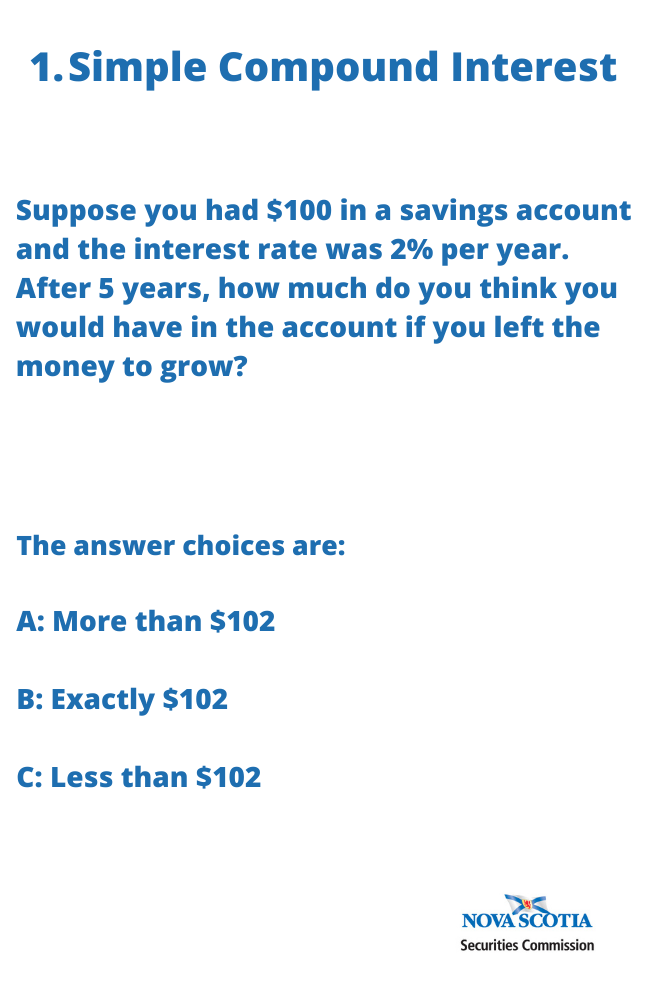

How well would you do? Let’s find out. Throughout the month our blog will going through the Investment Knowledge Index Questions. Today we start with the first two questions. The quiz begins with Question 1 on Simple Compound Interest:

The correct answer is:

With 2% interest you would have $102 after one year, so after five years you would easily have more than $102.

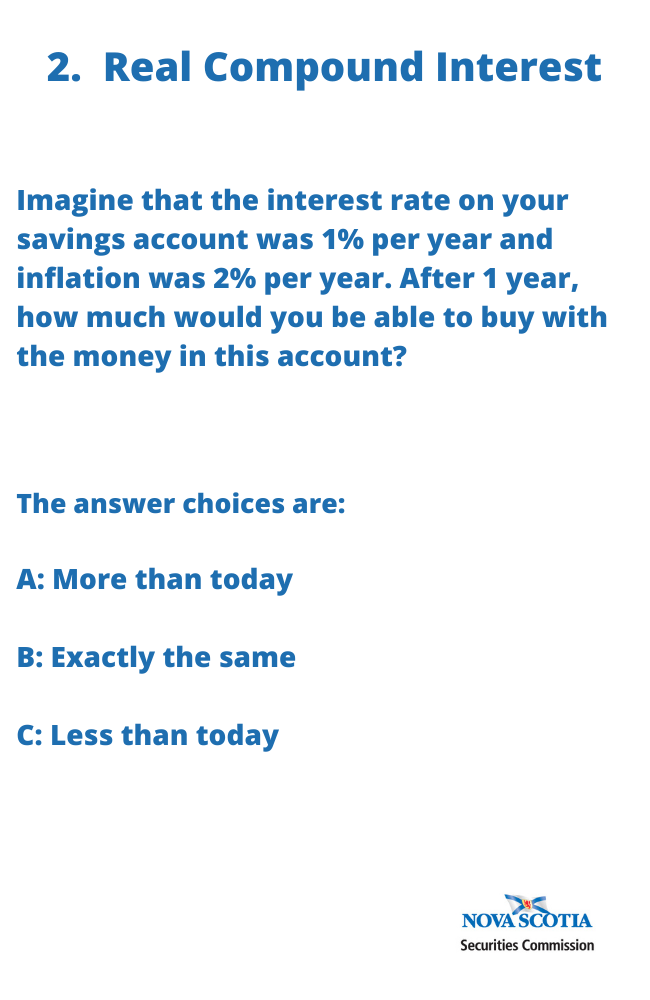

Questions 2 increases the difficulty slightly and looks at Real Compound Interest.

The correct answer is:

If inflation is rising faster than interest your money is not keeping up with inflation. This means you will not be able to purchase as much with your money in the future.

Are you off to good start in the quiz? Comeback next week for the next two questions to find out if your investment knowledge is high or low.