Submitted by nsscadmin on

November is Financial Literacy Month, and the Nova Scotia Securities Commission plans to hold investor education events and provide content throughout the month to help Nova Scotians make more informed investment decisions. Here’s a rundown of what we have planned for the month.

Events:

2024 Money Path Atlantic Conference: Mapping Financial Resilience

Thursday, November 7 - Best Western Truro – Glengarry, 150 Willow St, Truro

NSSC is pleased to be taking part in the 2024 Money Path Atlantic Conference. Commission staff will be on-site at the conference all day sharing investor education resources and content at our table. Investor Education and Communications Officer David Harrison will also be taking part in an “Ask Me Anything” panel on investing and securities from 2:10 – 2:40 p.m.

For more information on the 2024 Money Path Atlantic Conference, including the conference agenda and registration information, visit the conference website.

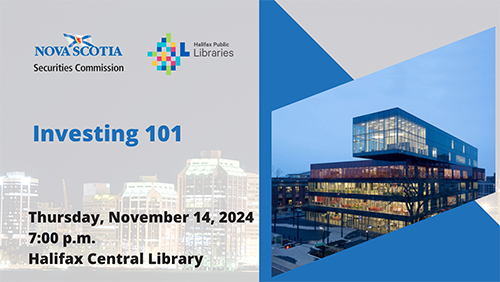

Halifax Central Library

NSSC has a pair of presentations scheduled at the Halifax Central Library during Financial Literacy Month.

Thursday, November 14, 7:00 p.m. Investing 101

Do you know the difference between saving and investing? What about an RRSP and a TFSA? Do you know your stocks from your bonds? Your mutual funds from your exchange-traded funds?

Join David Harrison from the Nova Scotia Securities Commission as he explains how securities regulation works in Canada and the differences between basic investments.

Thursday, November 28, 7 p.m. – Crypto assets and securities regulations

It continues to be a very volatile time for anyone investing in cryptocurrency and crypto assets. Do you know how crypto assets and the trading of these assets are regulated in Canada?

Join David Harrison from the Nova Scotia Securities Commission as he explains how crypto assets are regulated by securities regulators in Canada, what that means for crypto trading platforms and investors, and the risks around investing in this ever-evolving industry.

Monday, November 18, 3:00 p.m. – Crypto Assets and Securities Regulations and Investment Fraud Refresher

Our final presentation in our investor education series at the Flourish Centre 55+ is in November. This final presentation will look at how crypto assets and the trading of crypto assets are currently regulated in Nova Scotia, and provide a refresher on investment fraud prevention.

Before You Invest Blog

Our Before You Invest Blog will be sharing new content on some timely topics during Financial Literacy Month. On November 6, we’ll publish a post looking at what investments are eligible to be held in an RRSP and TFSA. There have been groups requesting some additions and changes to this list which makes it an opportune time to review it.

On November 13, we begin a two-part blog series on choosing an adviser. The first part on November 13 will look at why you might want to work with an adviser. The second part on November 20 will look at questions to ask when looking for an adviser.

On November 27 we’ll finish off Financial Literacy Month with a look at some of the differences between unregistered and registered crypto trading platforms (CTPs). Specifically, our Top 3. CTPs must be registered to offer crypto trading services in Nova Scotia. What are the top 3 things that registered CTPs must do to make investing safer.

Investor Education Videos

The Commission’s Investor Education video library on our YouTube channel will be growing in November with the introduction of two new videos.

On November 12 we’ll premiere a new video about finfluencers. Social media is overloaded with so-called financial experts offering “can’t miss” and “guaranteed money-making” advice and tips. Whether you’re using TikTok, Facebook, X, Instagram, or another social media platform, the investment advice offered by finfluencers can be suspect and even dangerous to your financial well-being. Our new video will look at some of the dangers of getting investment advice from finfluencers.

On November 19 we’ll premiere the latest video in our “Three minutes on…” series. This time we’re taking three minutes to talk about capital gains and capital losses.

Student Connections

The Commission also has several presentations scheduled at high schools and universities in November including: Saint Mary’s University, C.P. Allen High School, and Woodlawn High School.

Through the Student Connections program, we visit high schools, colleges, and universities both in-person and virtually across the province to talk about investing and securities regulations. If you would like the Commission to talk to your students, or you would like more information on these presentations, please contact us.