Submitted by nsscadmin on

If you’re investing you usually want to know how well, or maybe how bad, your investments are doing. One of the easiest ways to do this is to calculate the return on investment (ROI).

An ROI shows you the gain or loss of an investment relative to its cost and is expressed as a percentage. It gives you an approximate measurement of the profitability of an investment. Since investing has risk and losses are possible, there may also be no profitability.

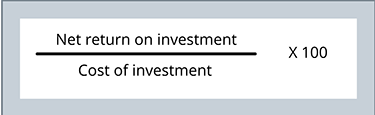

Now let’s look at a formula for calculating ROI.

When using this formula, if you get a positive number, you’ve made a profit, while a negative number is a loss.

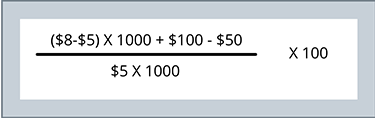

Let’s plug some numbers into the formula.

You’ve bought 1000 shares in Company X at a cost of $5 per share. One year later you decide to sell all your shares at a price of $8 per share. During this year you’ve also earned $100 in dividends from your shares and for the purchase and sale, you paid $50 in commissions.

Using the numbers provided, the formula would look like this:

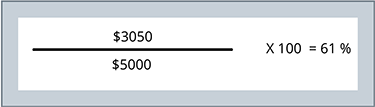

When we work out the math, we get:

Our ROI in this example is 61 percent.

There’s one other point to consider when comparing the ROI of two different investments. An ROI may not take into account the time an investment has been held. For example, you may have one investment that has an ROI of 50 percent and another that has an ROI of 25 percent. At first glance, the first investment with an ROI of 50 percent appears to be the better investment. However, what if you’ve held the first investment for five years and the second investment for only one year? Which is the better investment now? Remember to take all factors into account when comparing ROI.