Submitted by nsscadmin on

As we’ve stated numerous times in the past, to sell or advise on securities and derivatives in Nova Scotia you must be registered with the Nova Scotia Securities Commission, unless an exemption applies. The same goes for every province and territory in Canada. But what constitutes investment advice? How does someone know what they’re telling another person about investing is advice and requires them to be registered? Let’s look at a few examples and explain why registration is or is not required in these situations.

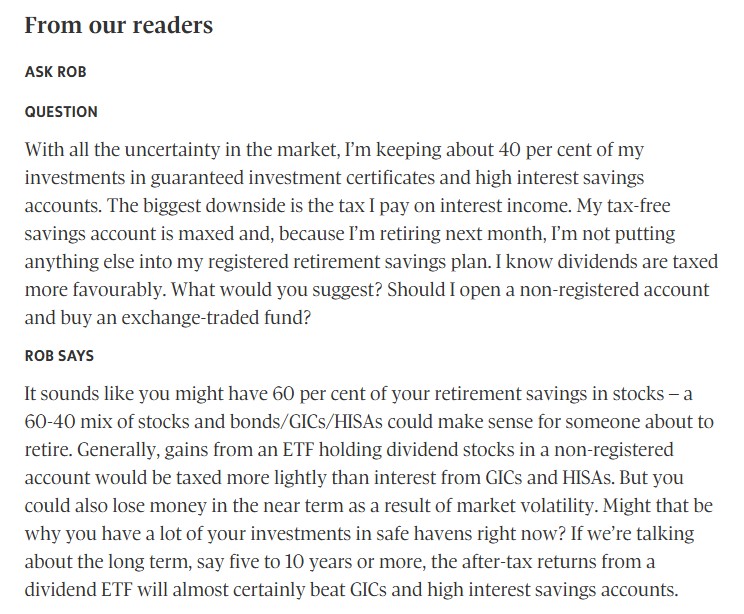

Rob Carrick is a well-known columnist with The Globe and Mail who recently retired. He published his Carrick on Money column weekly for decades. In recent editions of this column he has answered readers questions, often questions about investing. Here’s a recent question that was published on April 24, 2025:

According to NSSC registration staff, what Rob is providing here is not considered to be investment advice but is instead essentially financial planning. For those unaware, the NSSC does not regulate financial planners and anyone deemed to be a financial planner does not require registration. The key difference in our example is that Rob is not mentioning any specific securities that the person should buy. He is simply referring to asset classes, which in the example are dividend ETFs. It would constitute advice if Rob’s answer stated something like you should liquidate all your GICs and purchase a specific ETF with the money.

What about people providing advice recommendations or answering questions online or through social media? For example, on Reddit there is a subreddit called r/CanadianInvestor. There are daily posts in this subreddit asking questions about investing. The day this blog post was written for example a few recent posts to the subreddit included:

Looking for dividend stocks that actually make sense

XIU, XIC, XEQT?

Covered calls on TSX?

In these three posts the original poster asks questions about what they should invest in. That included asking for dividend stock recommendations, which is preferrable between XIU, XIC, and XEQT, and whether they should invest in covered calls on the TSX. The responses varied from basic to complex but often included strong to the point investment recommendations. Why does this not constitute investment advice that requires registration?

Here’s what our registration staff have to say about that. Any individual or firm that is in the business of providing advice must be registered. To make the determination if someone is “in the business”, we look at the business triggers that were used in providing the advice. In this case, the individuals who replied to the poster are not receiving any compensation for their opinions, nor are they holding themselves out as professional advisors. As such, we would not consider them to be in the business of providing advice.

Some of the other more common business triggers we look for include:

· promoting securities or stating in any way that the individual or firm will buy or sell securities.

· intermediating a trade between a seller and a buyer of securities.

· Contacting anyone to solicit securities transactions or to offer advice.

One thing to remember when looking at investment advice, or recommendations from someone you don’t know whether it’s online, in a publication, or on social media. If the advice is coming from a stranger, or from someone that doesn’t even have to identify themselves, you have no idea what their background is, where that recommendation is coming from and if they are being paid to promote the investment. Before following through on any investment recommendations or advice, get more than one opinion and do your own research to be as comfortable as possible before investing any money. Ensure you aren’t taking on too much risk and don’t invest more than you can afford to lose.