Submitted by admin on

The simple answer to this question is: Yes, every investment has some amount of risk. Period. When it comes to investing, the higher the potential return, the higher the risk. Maybe the most important thing to remember when it comes to risk and investing is –

There is no such thing as a high return, no risk investment.

If you can remember and abide by this, you can save yourself a lot of trouble in the future. A higher potential return may come with higher risk, but more risk does not guarantee a higher return.

So what is risk? The basic definition of risk is “a situation involving exposure to danger.” When it comes to investing, you can boil that down to “the possibility of financial loss.”

“The possibility of financial loss” breaks down into two parts: The frequency of the loss (how often the loss takes place) and the size of the loss. How you balance and accept risk and the result depends on your risk tolerance.

Risk tolerance is the amount of risk you are willing to take on. This may depend upon:

- When you need your money

- How you react to the ups and downs of the markets

- If you have any debts

- If you have other sources of income to rely on

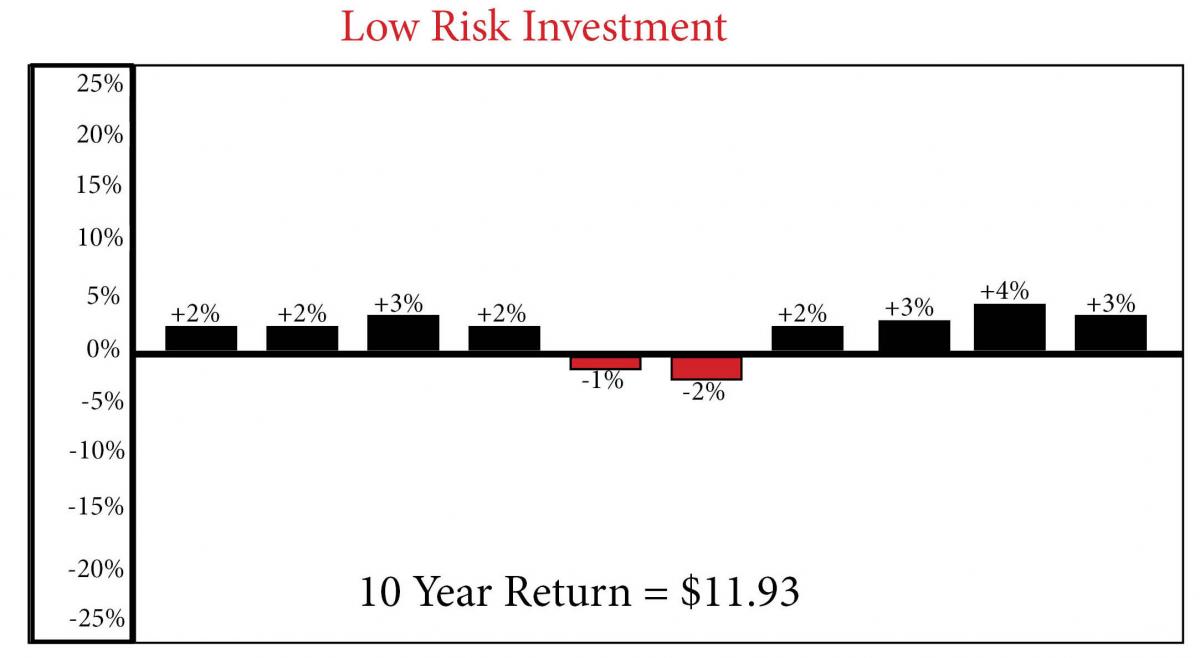

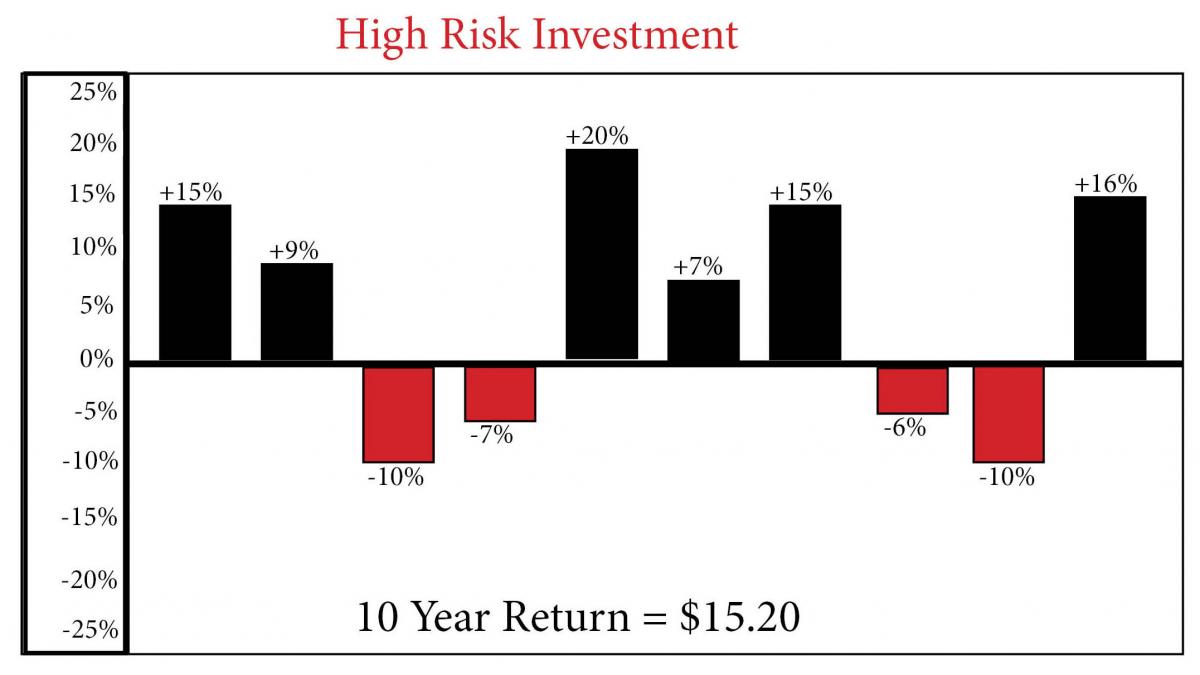

Here is an example of a 10-year investment in a low risk investment plan vs a higher risk investment plan to show how risk tolerance can affect the outcome.

If you invest $10 over 10 years these are your returns from each plan….

In the low risk investment plan you have more steady returns with only two years losing money. In the high risk investment plan you have more sporadic returns, and lose money during four years. At the end of the 10 years the low risk plan produces a return of nearly 20 per cent, while the high risk return delivers a return of 50 per cent.

However, dependent on your risk tolerance, or an unexpected change in your income or cash flow, you may have chosen to withdraw your investment earlier than 10 years. For example, if you had withdrawn your money in the low investment plan after year six your return would have only been six per cent. In the high risk investment plan a withdraw after four years would have given you’re a return of only four per cent, while a withdrawal after seven years would have given you a slightly higher return than you would receive after 10 years.

When investing always be aware of your risk tolerance, your time horizon and your financial goals. Keeping all three in check will help you ride out market volatility and make your journey in investing much smoother.