Submitted by admin on

A mutual fund is a specific type of investment fund; a collection of investments such as stocks and bonds. This collection of investments is owned by a group of investors and managed by a professional money manager. When you purchase a mutual fund, you are joining this group of investors. Mutual funds, unlike most other types of funds are open-ended. This means as more people invest in the fund, the fund can issue new units.

A mutual fund can focus on specific types of investments. For example, a fund could specialize and invest in stocks from large companies, or specific business sectors, or focus mainly on government bonds. There are also funds that are extremely diverse and invest in a variety of different investments. An example of a few funds and their main investments include…

Money Market Funds – Short-term fixed income securities

Fixed Income Funds – Fixed income securities, such as government or corporate bonds

Growth or Equity Funds – Equities, such as stocks or income trust units

Balanced Funds – A mix of equities and fixed-income securities

Global Funds – Foreign equities or fixed-income securities

Index Funds – Equities or fixed-income securities chosen to mimic a specific index such as the S&P/TSX Composite

Mutual funds are readily available through banks and credit unions, financial planning firms, brokerage firms, mutual fund dealers, and trust companies. There are typically no time restrictions on mutual funds, meaning they can be bought or sold at any time.

Since mutual funds are an investment that means they have risk. The amount of risk you take on depends on what your mutual fund is investing in. There is always a chance you could lose money on a mutual fund because its value is determined by the value of the investment within the fund. If the stocks or bonds within the fund go up in value, the value of the fund will rise. However, if the stocks or bonds within the fund go down, the value of the fund will drop. This can make some mutual funds very volatile and prone to frequent increases or decreases in value. It is up to you to discuss with your adviser how much risk you are willing to take on when you purchase a mutual fund.

When purchasing a mutual fund not only should you discuss the risk involved, but also the fees that come along with it. EVERY MUTUAL FUND HAS FEES. But, they can vary from fund to fund.

Here are examples of some of the common fees found with mutual funds.

Sales Charges - These are commissions that you pay when you buy or sell a mutual fund. Not all funds come with sales charges, so make sure to ask before purchasing.

Management expense ratio (MER) – Each mutual fund pays an annual management fee to the company that is managing the fund and the investments. Mutual funds also pay their own operating expenses. These include legal and accounting fees, custodial fees, and bookkeeping costs. Some mutual funds pay a fixed administration fee to cover their operating expenses. An MER is the combined total of the management fee and the operating expenses. It is shown as a percentage of the fund’s assets. For example, if a $100,000 fund had $2,000 in expenses for the year the MER is two per cent. Management fees and operating expenses aren’t paid directly, but instead reduce the return of the fund as a percentage of the fund’s value. Always review the MER to understand how much you are paying in fees from your fund.

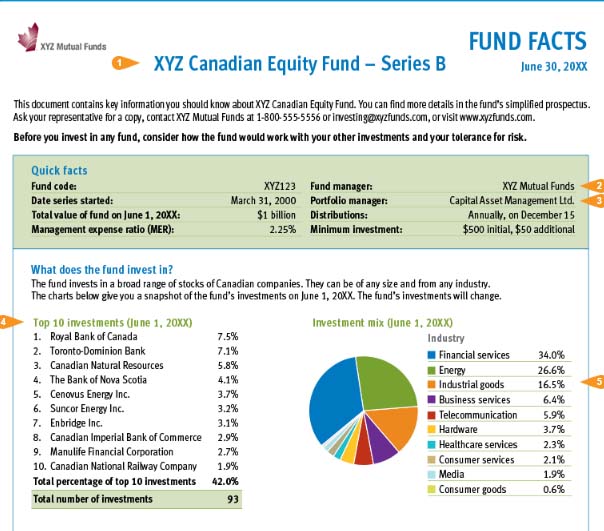

Before purchasing a mutual fund you should always review the Fund Facts document, or the prospectus for more detailed information. Fund Facts, which must be provided to you by the person or firm selling the mutual funds, gives you all the necessary information you need to know if the fund is right for you.

Some of this information you’ll find in a Fund Facts include:

-the date the fund was started

-its current value

-the MER

-when fund distributions are made

-the minimum needed to invest

-what kind of investments make up the fund

-its risk rating

-the funds past performance

To see an example of a Fund Facts click on the image below: