Submitted by nsscadmin on

Earlier this month we reviewed the Client Relationship Model Phase 2 (CRM2) required Annual Performance Report that outlines how your investment account has performed over the previous 12 months. Under CRM2 you are also required to receive an annual fees and charges report that outlines the fees and charges you have paid on your account during the previous year.

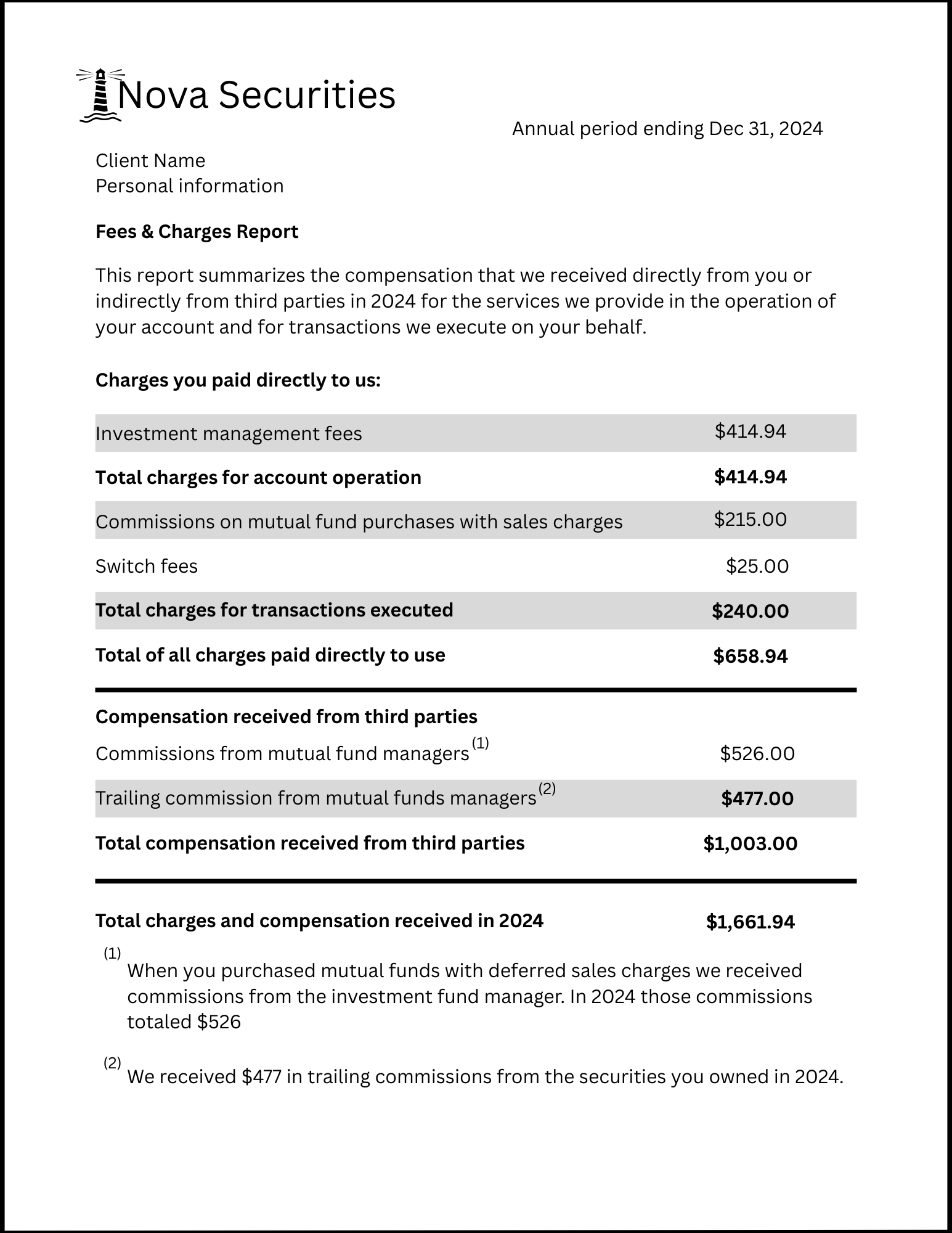

Just like the annual performance report, there is no standard design for the fees & charges report, so you may notice slight differences when comparing statements issued by different financial institutions. However, there are requirements on what information must be included in the fees and charges report. This post will outline this information and our statement example (below), will show you how they may appear on your annual statement. To more closely review the example it is available as a downloadable PDF by clicking on it.

The fees and charges report is a summary of all fees and charges paid in the past 12 months, and they must be broken down into an easy to read and understandable itemized list.

In most reports the fees and charges are separated into those paid directly by the client and compensation received from a third-party.

In the example statement you can see the direct charges include:

- Management fees

- Commissions

- Switch fees

Each different type of fee is itemized and calculated to provide the overall total of directly paid fees. These are the fees you have paid for your account to be managed.

Underneath the directly paid fees is compensation from third parties. Depending on the type of securities you own this section could be lengthy, or it may not have any data at all. In the example, these are charges from mutual fund commissions. This incudes costs from deferred sales charges (DSCs), and trailing commissions. You may be aware that under securities laws DSCs are no longer allowed. However, any funds that were purchased prior to the ban on DSCs may still be in client’s accounts and because of this DSCs may still appear on your statements.

The compensation listed here may not be paid directly by the client, but the commission can still lower your annual returns.

At the bottom of the example statement both directly paid charges and third-party compensation are added together to provide the overall total of all charges and compensation the broker received for managing the account.

Knowing how much you are paying in fees and charges on your investments is important to help you make the right investment decisions. The fees and charges report provides this important information. However, the information needs to be analysed in tandem with your annual performance report. Your fees and charges should be a reasonable amount when compared to your returns. Be sure you are reviewing both statements to ensure your investment performance and fees will help you reach your investing goals.