Submitted by nsscadmin on

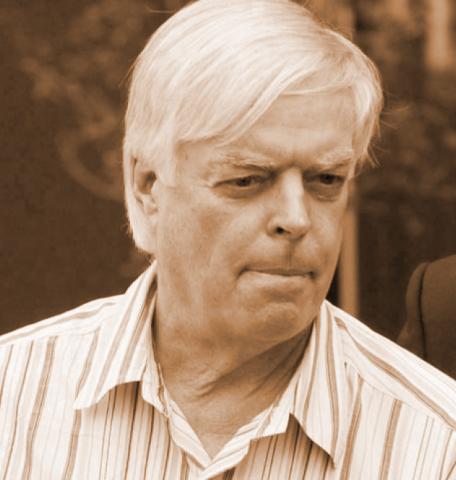

Bertram Earl Jones ran a Ponzi scheme for decades in Quebec that cost his victims, including members of his own family, a reported $51.3 million Canadian.

In 1979 Jones began his own investment advising business. At the time he did not register with any securities regulator and he never would. Jones would go about offering investment advice and claim to sell securities unregistered for 30 years.

Between 1982 and 2009 Jones promised his investors greater than market returns. And, he actually delivered them. But, he did so using his clients’ own money and never invested a cent of the money that was given to him. According to the Montreal Gazette Jones received $50 million from investors and he never invested any of it. Instead he spent $13 million to finance his lavish lifestyle and over the years returned $37 million to his investors as interest to maintain his Ponzi scheme.

As with every Ponzi scheme eventually the money coming into Jones ran out. When this happened his coffers went dry and the scheme collapse leaving his 158 victims, including his brother and his wife penniless.

When news of Jones’ scam surfaced he actually disappeared. Between July 6-26, 2009 Jones couldn’t be found. After authorities threatened to go through with insolvency proceeds against his business Jones finally turned up and surrendered to the police on July 27, 2009. He and his business declared bankruptcy a few days later.

Jones would admit to running a Ponzi scheme for at least 20 years and plead guilty to two counts of fraud. He was sentenced to 11 years in prison. After serving four years he was released from prison on March 20, 2014.

Some of Jones’ victims successfully launched a lawsuit against the Royal Bank of Canada. They alleged that RBC, where Jones deposited and withdrew the money for his Ponzi scheme, should have realized he was misusing his accounts and done something about it. The suit was eventually settled with the victims reportedly receiving about 30 cents on the dollar for the money they lost to Jones.

Can you spot the Red Flags of Investment Fraud in the Earl Jones story?

1. You were promised a high return for low risk.

2. Is there a credible source that can validate the investment?

3. Are they registered?