Submitted by nsscadmin on

In a previous post on mutual funds we briefly mentioned Fund Facts and some of the information they include. Fund Facts must be filed by all mutual funds annually and they must be updated whenever there is a material change to the fund. The NSSC recommends any investor interested in purchasing a mutual fund thoroughly review the Fund Facts document before making any decisions. To make that review process a little easier here is what you’ll find in a Fund Facts and the information it provides.

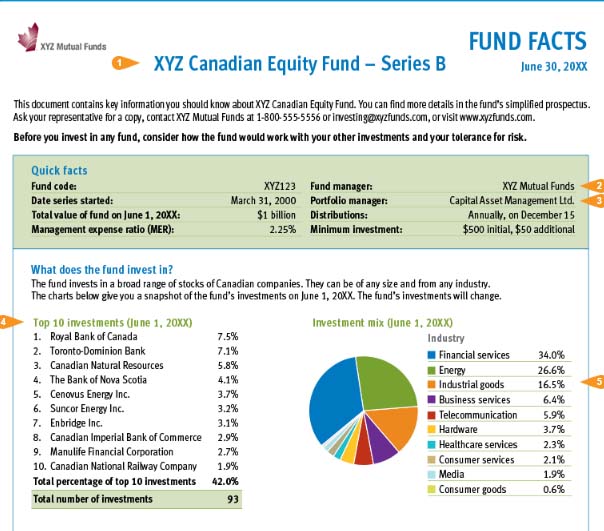

At the top of every Fund Facts document, below the name of the fund, you will find the “quick facts” on the fund. This includes the basic information on the background of the fund, including the date the fund started, its total value at the time the Fund Facts was produced, the fund’s management expense ratio (MER), the name of the fund manager and portfolio managers, the fund’s distributions and the minimum investment needed to purchase the fund.

Below that you’ll find information on what the fund in invested in. This includes the fund’s Top 10 investments and the percentage of the fund invested in them. The Top 10 also lists the total number of investments found in the fund. Also in this section is a chart showing the investment mix. The chart will give a potential investor a better idea on the fund’s diversity and investment exposure. Depending on the type of fund the mix can be broken down by industry, asset class, geographic location or other categories.

The next section analyzes the fund’s risk. Each fund will be given a risk rating from low to high. The rating is determined based on the fund’s volatility and how much the fund’s returns have changed over the years. It’s important to note that no matter how low or high the risk rating any fund can still lose money and the rating can change over time.

Next is a rundown of the fund’s past performance. This will include the fund’s annual returns after expenses for the past 10 years. It also lists the best and worst three-month returns from the past 10 years, and the average return. This information is useful to know what kind of returns a fund has reported in the past, but it’s also important to remember that a fund’s past performance does not tell you how it will perform in the future.

The next section asks the question who is this fund for and talks about taxes. Who is this fund for indicates whether the fund is for long-term investors, short-term investors, investors looking for a diverse investment or a centralized investment and other specific investment types. This section will help you determine if the fund fits into your investment goals.

In the tax section it will tell you the tax considerations that come along with investing in mutual funds.

A very important section comes next – How much does it cost? Whenever you’re looking to purchase a mutual fund you need to know how much it will cost to purchase, hold and sell the fund. All of this is listed here. It starts with sales charges, which are what you must pay to purchase the fund. Next are fund expenses. These are not paid directly, and instead are deducted from your returns. Make sure you examine these closely and understand how much they cost as they will affect the size of your returns. Lastly are other fees. You may have to pay other fees when buying, holding or selling the fund, which will be outlined here.

The last section includes a disclaimer on if you should change your mind and where to go for more information. The disclaimer lets you know your options in case you change your mind after purchasing the fund. This depends on the province where you purchased the fund and is determined by provincial securities law.

The for more information section will list the contact information for the company selling the fund. Should you still have question after going through the Fund Facts document this is who you would contact for more info.